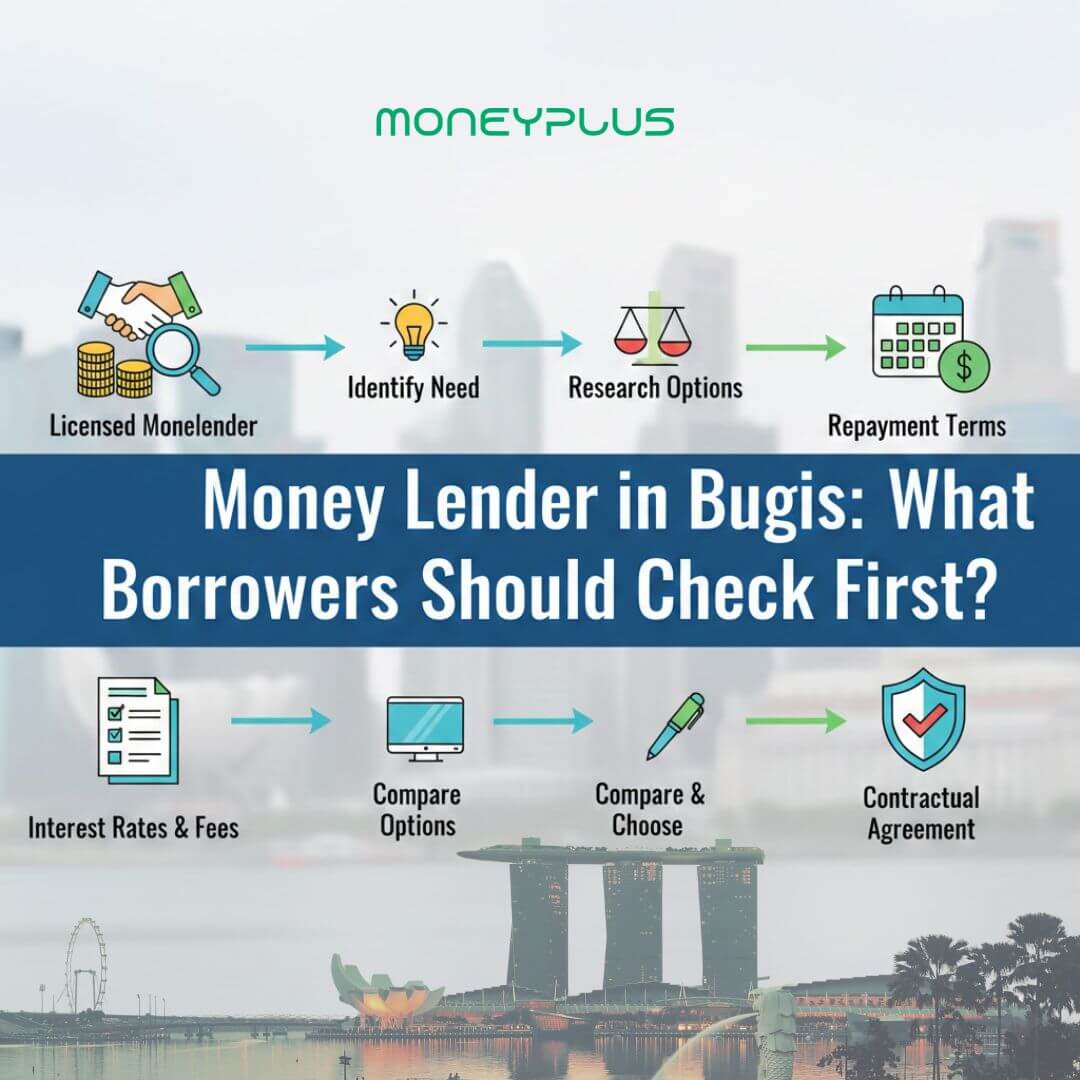

If you are searching for a money lender in Bugis, it is important to understand how licensed money lending works in Singapore before committing to any loan. Borrowing can be safe and regulated when done correctly, but only if borrowers know what to check first.

Singapore has a strict regulatory framework overseen by the Ministry of Law, which protects borrowers from unfair practices. Understanding these rules helps you avoid unlicensed lenders and make informed financial decisions within Singapore.

Verify the Lender Is Properly Licensed as a Money Lender in Bugis

The first step when choosing a money lender in Bugis is to confirm that the lender is licensed under Singapore law. Licensed lenders are listed on the official Ministry of Law registry and must comply with strict lending guidelines.

Borrowers should always cross-check the lender against the official list of licensed moneylenders in Singapore published by the Ministry of Law. This ensures the lender operates legally and follows regulated interest rates and fee limits.

Understand the Loan Types Offered by Licensed Money Lender in Bugis

For short-term needs, borrowers often explore a payday loan Singapore option, which is intended for temporary cash flow gaps rather than long-term borrowing.

Those facing income challenges may consider a bad credit loan Singapore solution, which evaluates repayment ability instead of relying only on credit scores.

When dealing with urgent situations, some borrowers look into a fast urgent cash loan Singapore, designed for emergency use under regulated conditions.

If managing multiple debts, a debt consolidation loan Singapore can help combine repayments into one structured plan with clearer timelines.

Other regulated loan options may include wedding loan Singapore arrangements for planned expenses, medical loan Singapore support for healthcare-related costs, travel loan Singapore planning for overseas needs, and bridging loan Singapore solutions for temporary property-related funding.

Read Reviews and Assess Local Reputation

Local reputation matters when choosing a money lender in Bugis. Reviews provide insight into borrower experiences, service quality, and transparency.

Searching for money lenders near me often reveals local feedback that highlights how lenders treat borrowers throughout the repayment period. A trusted money lender Singapore usually maintains consistent reviews and a verifiable physical office location.

Watch for Red Flags and Unethical Practices

Licensed lenders follow strict communication and advertising rules. Borrowers should be cautious of lenders who contact them unsolicited, request Singpass details visible over messaging apps, or demand upfront fees before approval.

If a lender advertises unrealistic promises or avoids written contracts, it may indicate unlicensed activity. Borrowers should step away immediately and verify information independently.

Know Your Borrowing Rights in Singapore

Borrowers in Singapore are protected by clear regulations that cap interest rates, late fees, and total repayment amounts. Understanding these protections ensures you are not overcharged.

Official guidance from the Ministry of Law explains borrower rights and responsibilities in detail, helping borrowers make informed decisions when choosing licensed lenders.

Choosing a Responsible Money Lender in Bugis

Selecting a money lender in Bugis should be based on legality, transparency, and suitability rather than speed alone. Licensed lenders are required to assess affordability and provide clear contracts before disbursement.

Borrowers seeking regulated services may explore licensed options through Moneyplus, a licensed moneylender in Singapore, which offers structured loan information across various regulated loan types.

Frequently Asked Questions

Is it safe to borrow from a Money Lender in Bugis?

Yes, as long as you choose a licensed money lender in Bugis listed by Singapore’s Ministry of Law and review all loan terms before signing.

How do I verify if a money lender is licensed?

You can check the official list of licensed moneylenders in Singapore on the Ministry of Law website to confirm registration and licence status.

What loan options are available from licensed moneylenders?

Licensed lenders may offer personal loan, payday loan, bad credit loan, debt consolidation loans, medical loans, travel loans, and bridging loans, depending on eligibility.

Can foreigners apply for loans in Singapore?

Most licensed moneylenders focus on Singapore Citizens and Permanent Residents. Some may have limited options for eligible foreigners, subject to approval.

What should I avoid when choosing a money lender?

Avoid lenders who request upfront fees, pressure you to borrow more, refuse to provide written contracts, or advertise via SMS or WhatsApp.

Conclusion: Money Lender in Bugis

Borrowing responsibly starts with knowledge. By verifying licences, understanding loan types, comparing costs, and recognising red flags, borrowers can safely navigate money lending in Bugis.

If you are exploring regulated loan options, review the available information carefully and ensure that all agreements and features comply with Singapore’s licensed money-lending framework before proceeding. Contact us today or visit our website to apply!

Hours: 11:00 AM – 7:00 PM Monday to Saturday. Closed on Sundays & Public Holidays.