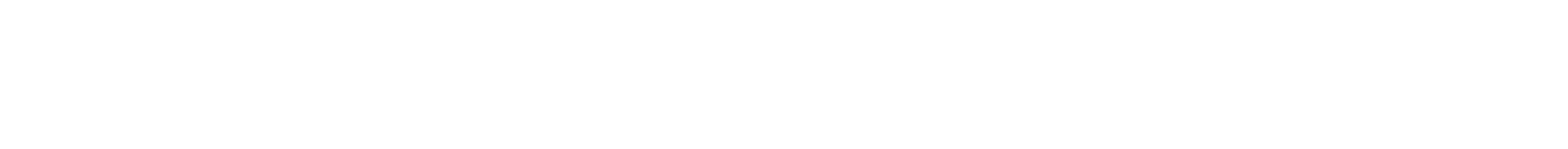

If you are looking for a money lender in Bugis, the safest choice is a lender licensed by Singapore’s Ministry of Law. Always verify the licence, understand repayment terms clearly, and avoid lenders that pressure you or hide fees.

Introduction

Searching for a money lender in Bugis can feel overwhelming, especially when you need quick financial support. With many options available, knowing how to identify a licensed and reliable lender is essential. This guide explains what to look out for, how to verify legitimacy, and how to make a responsible borrowing decision in Singapore.

Why Choosing a Licensed Money Lender in Bugis Matters

Licensed money lenders in Singapore operate under strict regulations set by the Ministry of Law. These rules protect borrowers by limiting fees, controlling interest rates, and ensuring transparent loan contracts.

Choosing a licensed money lender in Bugis helps you:

- Avoid illegal lenders and loan scams

- Understand total borrowing costs upfront

- Access clear repayment schedules

- Receive fair and lawful treatment as a borrower

How to Verify a Licensed Money Lender in Bugis

Before engaging any lender, take a few minutes to confirm their licence status.

Check the Ministry of Law Registry

Visit the official Ministry of Law website and search the list of licensed money lenders. Confirm that the business name and address match what the lender provides.

Confirm the Physical Office Location money lender in Bugis

A licensed money lender in Bugis must operate from an approved office address. Be cautious of lenders who only communicate via messaging apps or refuse face‑to‑face meetings.

Review Loan Documents Carefully

Licensed lenders must provide a written contract clearly stating interest rates, fees, repayment terms, and consequences of late payment. Never sign documents you do not fully understand.

Key Factors to Compare Before Choosing a Money Lender

Not all licensed lenders offer the same experience. Comparing options helps you borrow responsibly.

Interest Rates and Fees

Understand the maximum interest rate allowed and check for additional fees such as administrative or late payment charges.

Repayment Flexibility money lender in bugis

Some lenders offer repayment schedules that better suit your income cycle. Clarify instalment amounts and due dates in advance.

Transparency and Communication

A reliable money lender in Bugis should explain terms clearly, answer questions patiently, and avoid aggressive sales tactics.

Warning Signs to Avoid

Stay cautious if you encounter any of the following:

- Requests for upfront fees before loan approval

- Guarantees of approval regardless of income or eligibility

- Threats, harassment, or pressure to borrow quickly

- Instructions to meet outside the lender’s registered office

These are common indicators of unlicensed or unsafe lending practices.

Responsible Borrowing Tips Near Money Lender in Bugis

Borrowing should always be a planned decision. Consider your monthly budget, ensure repayments are manageable, and borrow only what you truly need. Licensed money lenders are required to assess affordability, but personal responsibility remains important.

Frequently Asked Questions

Is every money lender in Bugis licensed?

No. Only lenders listed under the Ministry of Law’s Registry of Moneylenders are legally licensed to operate in Singapore.

Can a licensed money lender guarantee loan approval?

No. Licensed lenders must assess eligibility and affordability. Guaranteed approval is a red flag.

Are interest rates regulated in Singapore?

Yes. The Ministry of Law sets maximum interest rates and fees that licensed money lenders can charge.

Should I borrow from multiple lenders at once?

This is generally not recommended, as it increases repayment risk. Always assess your financial capacity before taking additional loans.

Conclusion

Choosing the right money lender in Bugis starts with verifying licensing, comparing terms carefully, and understanding your repayment obligations. By following these steps, you can protect yourself from risks and make informed financial decisions within Singapore’s regulated lending framework.

Contact us today for more information.

Hours: 11:00AM – 7:00PM Monday to Saturday. Closed on Sundays & Public Holidays.