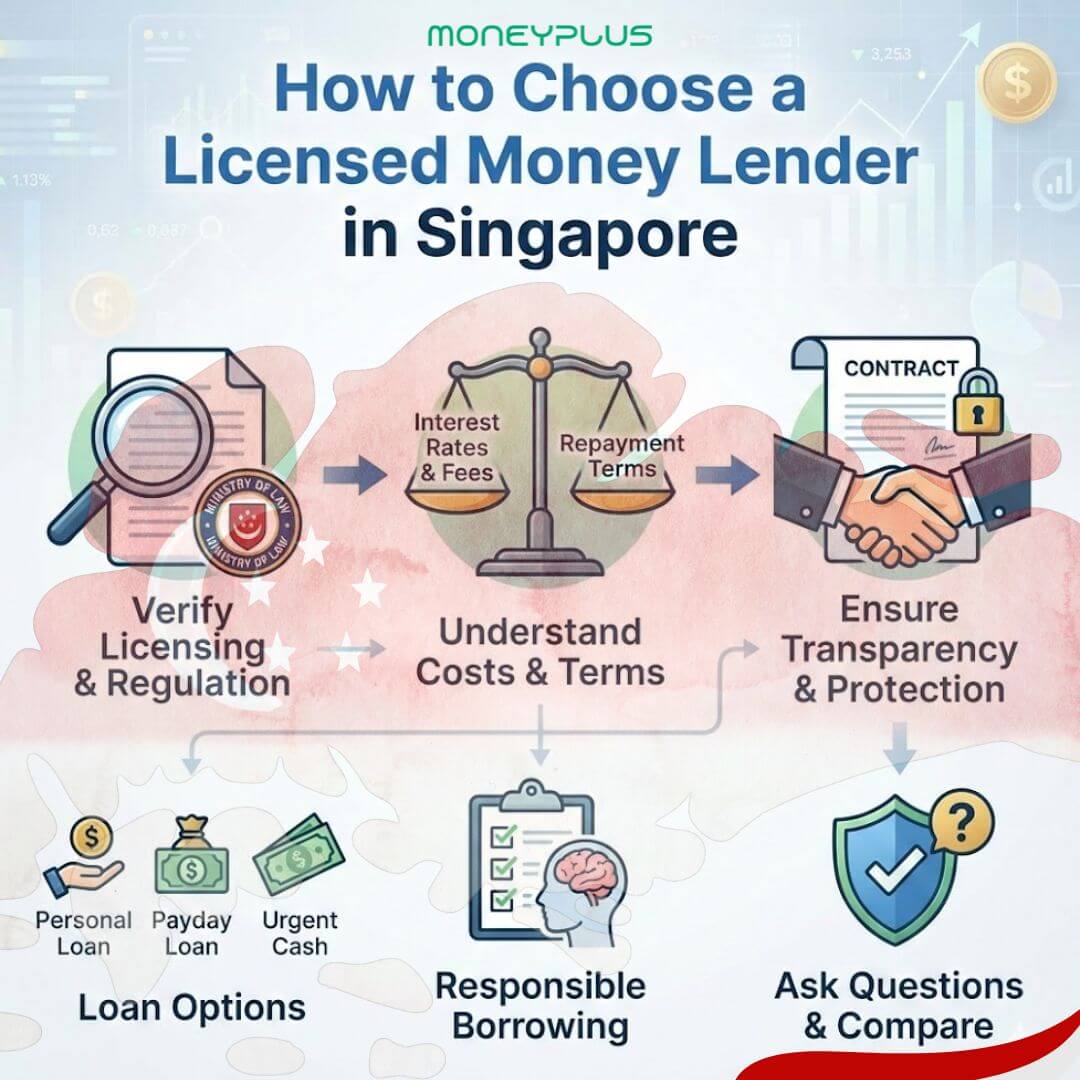

Choosing the right Money Lender in Singapore option starts with checking licensing, understanding loan terms, and ensuring the lender explains costs clearly so borrowers can make informed decisions.

Introduction

Finding a reliable licensed money lender singapore can feel confusing, especially with so many options available online and nearby. Visiting the Moneyplus is a good starting point for understanding available services. Borrowers often search for a money lender near me when they need fast support, but making the right choice requires more than convenience. Reviewing the personal loan options helps clarify what is suitable. Understanding how licensed lenders operate in Singapore helps borrowers protect themselves and borrow responsibly.

What Is a Licensed Money Lender in Singapore?

A licensed money lender singapore is approved and regulated by the Ministry of Law. These lenders must follow strict rules on interest rates, fees, advertising, and borrower protection. Unlike unregulated sources, a licensed lender operates transparently and provides clear contracts.

Borrowers looking for a best licensed money lender should always verify the licence before proceeding, especially when considering an online money lender singapore. You can cross-check details against the official Ministry of Law list.

Why Licensing Matters for Borrowers

Working with a licensed lender ensures legal protection. Borrowers who choose a best licensed money lender Singapore benefit from regulated practices, proper documentation, and fair treatment. This is particularly important for individuals seeking a bad credit loan Singapore, where clear explanations prevent misunderstandings. Reading about bad credit loan guidance can be helpful.

Types of Money Lender in Singapore Loans Offered by Licensed Lenders

Licensed lenders in Singapore provide several loan options depending on individual needs, including options such as a wedding loan Singapore, travel loans in Singapore, or a bridging loan Singapore for specific situations. These may include personal loans, a payday loan singapore, or support for urgent situations such as an urgent cash loan today. Each option is explained further on the payday loan page.

Some borrowers may require an urgent cash loan today singapore, while others look for a fast cash loan singapore for short-term needs. Understanding the differences outlined on the fast urgent cash loan page supports better decisions. Understanding the purpose of each loan type helps borrowers select the most suitable option.

How to Evaluate Money Lender in Singapore Loan Costs and Terms

Before committing, borrowers should review interest rates, repayment schedules, and total costs. A responsible best money lender in singapore will explain these details clearly. Comparing information across the debt consolidation loan page and related guides such as how to consolidate debt in Singapore can also provide context. Comparing terms across best money lenders in singapore helps borrowers understand what is reasonable and compliant.

Online vs In-Person Licensed Money Lenders

Many borrowers now explore options through an online money lender Singapore, while others prefer visiting a physical office. Both approaches should still follow guidance from Singapore’s regulatory framework and the official list of licensed moneylenders in Singapore. Both methods can be legitimate, but borrowers should ensure the lender is licensed and transparent regardless of the channel.

Choosing the Right Lender for Your Situation

Selecting the best moneylender in Singapore depends on your financial needs, repayment ability, and understanding of the agreement. Reviewing details on the about us page can provide clarity. Some borrowers look for best money lenders Singapore that offer flexible repayment options, while others prioritise clear communication. Reading practical examples on the Moneyplus blog can help borrowers understand real-world scenarios.

For short-term needs, working with a Reliable short-term loan provider Singapore 2026 can help manage expenses responsibly, especially when supported by clear information. In specific cases, such as medical emergencies, a Trusted medical loan moneylender 2026 may be relevant. You can review related details on the medical loans page.

Responsible Money Lender in Singapore Borrowing in Singapore

Responsible borrowing means understanding obligations and borrowing only what you can repay. A Reliable money lenders in Singapore 2026 approach focuses on transparency, education, and borrower awareness rather than pressure. Independent reviews on Google Reviews also help borrowers assess credibility alongside educational resources such as how payday loans work in Singapore and how to get a loan with bad credit in Singapore.

Conclusion

Choosing a licensed money lender in Singapore requires careful evaluation, clear understanding, and responsible decision-making. By checking licences, comparing terms, and asking the right questions, borrowers can make informed choices that support their financial well-being.

Frequently Asked Questions

How do I know if a lender is licensed?

You can verify a lender’s licence through the Ministry of Law’s official list to ensure you are dealing with a regulated provider.

Are licensed money lenders safe for urgent needs?

Yes, licensed lenders follow regulations that protect borrowers, even when providing urgent loan options.

Should I choose the cheapest loan available?

Cost matters, but clarity, compliance, and your ability to repay are equally important when choosing a lender.

Contact us today for more information, or visit the apply section to explore available options.

Hours: 11:00AM – 7:00PM Monday to Saturday. Closed on Sundays & Public Holidays.