What does Bad Credit mean?

You can still get loan support in Singapore even with bad credit. Licensed money lenders offer regulated, transparent, and accessible solutions for urgent needs. This guide explains your options, what to expect, and how to borrow safely.

Bad credit can feel discouraging especially when unexpected expenses appear without warning. Medical bills, household emergencies, and essential monthly obligations don’t pause simply because your credit score isn’t perfect. In Singapore, however, borrowers still have viable and safe avenues to access short-term financial support.

Licensed money lenders regulated by the Ministry of Law provide structured solutions for individuals managing bad credit, offering access that traditional banks may not. This guide breaks down how these options work, why borrowing from a licensed lender matters, and what you should evaluate before taking your next step.

What Is a Bad Credit Loan in Singapore?

A bad credit loan refers to borrowing solutions designed for individuals who do not meet traditional bank criteria. Banks typically rely heavily on credit scores, but licensed money lenders look at your:

- Current income

- Employment stability

- Debt obligations

- Ability to repay

- Identity verification

This broader evaluation provides more opportunities for people seeking:

- urgent loans for bad credit

- fast cash loan Singapore options

- urgent money loan solutions

- reliable short-term loan provider Singapore 2025 alternatives

Licensed lenders focus on today’s situation, not your entire credit history.

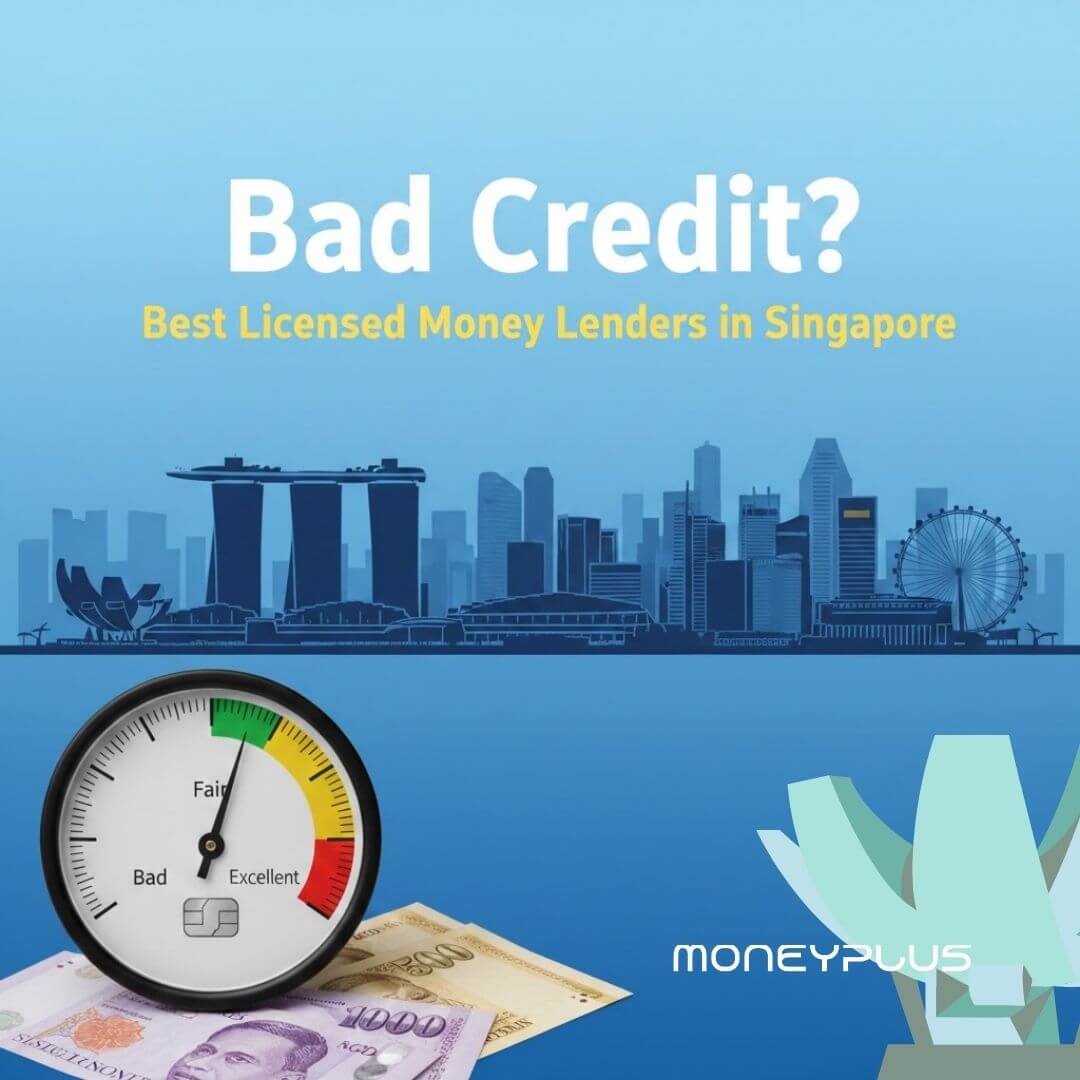

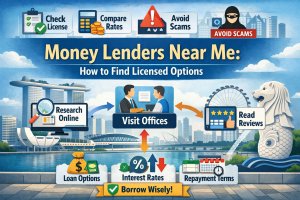

Why Choose Licensed Money Lenders for Bad Credit?

Licensed money lenders in Singapore operate under strict regulations established by MinLaw. These guidelines ensure transparent fees, capped interest rates, and ethical treatment of borrowers. You can confirm a lender’s licensing status here:

ROM List of Licensed Moneylenders (Official)

Borrowing from a licensed lender protects you from unfair practices and gives you access to clear, structured repayment options.

Benefits of Borrowing from Licensed Money Lenders

1. Accessibility for Bad Credit Borrowers

Licensed lenders assess beyond credit score. Instead of focusing on past financial performance, they consider your current income stability and repayment capacity. This increases approval opportunities for people needing:

- Bad Credit Loan Singapore

- money lender near me

- Urgent cash loan today Singapore options

2. Fast Application and Approval Process for Bad Credit

Most applications are reviewed within hours. For urgent needs, licensed lenders provide regulated and reliable urgent cash loan solutions today.

Related service page:

Fast Urgent Cash Loan Singapore

3. Transparent Terms

MinLaw requires lenders to present all fees, interest rates, and repayment schedules clearly. With regulated transparency, borrowers avoid hidden fees or unexpected charges.

Learn more about safe borrowing practices here:

How to Choose a Licensed Moneylender in Singapore

4. Flexible Repayment Options : Bad Credit

Borrowers can structure repayment schedules that align with their income patterns. This flexibility helps prevent rolling debt and reduces financial strain.

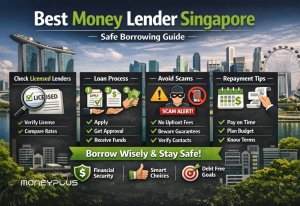

Comparison Table: Licensed Money Lenders vs Banks

| Feature | Licensed Money Lenders | Banks |

|---|---|---|

| Speed | Same-day approval | 2–7 working days |

| Credit Score Requirement | Flexible | Strict |

| Loan Amount | Small–medium | Medium–large |

| Regulation | MinLaw regulated | MAS regulated |

| Documentation | Simple | Extensive |

| Best For | Urgent cash, bad credit | High credit score borrowers |

Licensed money lenders provide accessibility that banks cannot match, especially for urgent or short-term needs.

How to Improve Your Chances of Approval With Bad Credit

Even with bad credit, these steps can increase your chances of approval:

1. Prepare Mandatory Documents

- NRIC / Work Pass

- Proof of income (payslips or bank statements)

- Employment details

- Proof of residence

2. Keep Your Outstanding Debts Low to Avoid Bad Credit

Lenders review your existing commitments. Reducing unnecessary debt strengthens your application.

3. Borrow Only What You Need

Borrow responsibly and avoid unnecessary obligations. This supports both your approval chances and repayment success.

4. Be Honest About Your Situation

Lenders appreciate transparency. When you communicate clearly about your financial challenges, they can better tailor solutions within regulatory limits.

Key Features to Look For in Licensed Money Lenders

Before choosing a lender, evaluate the following:

Licensing Status

Always confirm through MinLaw’s official directory.

Clear Communication

Trustworthy lenders explain fee structures and repayment terms in simple, understandable ways.

Proven Track Record

Look for lenders with positive reviews and consistent customer support experiences.

Responsible Borrowing Practices

A reliable lender emphasises sustainable borrowing and does not pressure clients into taking more than they can manage.

Why Singapore Is Ideal for Borrowers With Bad Credit

Singapore’s lending environment is one of the most strictly regulated in Asia. Borrowers benefit from:

- Clear rules preventing exploitation

- Transparent fee structures

- Fair mediation options

- Multiple licensed lenders to compare

- Accessibility for urgent and bad credit needs

This stability empowers borrowers to explore the best money lenders in Singapore and the best licensed money lender Singapore options confidently.

Related Services You Can Explore

To better understand loan types, you may explore these service pages:

Debt Consolidation Loan Singapore

Additional Helpful Guide

How Payday Loans Work in Singapore

Best Moneylender in Singapore 2025

FAQs About Bad Credit Loans in Singapore

1. Can I get a loan if I have bad credit?

Yes. Licensed lenders evaluate your current income and repayment ability, not just your credit score.

2. How fast can I receive the loan?

Most licensed lenders process and disburse loans within the same day.

3. Are licensed money lenders safe?

Yes. They follow strict MinLaw regulations designed to protect borrowers.

4. Do I need collateral?

No. Bad credit loans in Singapore are unsecured.

5. Can foreigners apply?

Yes, if they have valid work passes and proof of income.

6. Can I apply online?

Many licensed lenders offer secure online applications for added convenience.

7. What happens if I cannot repay on time?

Contact your lender early. They may adjust repayment terms within regulatory guidelines.

Contact Us

Contact us today for more information

Hours: 11:00 AM – 7:00 PM Monday to Saturday

Closed on Sundays & Public Holidays