Life can be unpredictable and at some point, we may find ourselves in unexpected situations where financial aid becomes necessary. Here, emergency loans come in useful, designed to provide quick access to funds for urgent needs such as medical bills, car repairs, or home repairs. However, while these loans often have faster approval processes and disbursement timelines compared to traditional loans, several considerations and preparations must be made to ensure a seamless and successful outcome. From navigating the application procedure to maximising benefits, discover the dos and don’ts that will empower you to create a robust financial safety net in unforeseen circumstances!

Assessing Genuine Emergencies

Distinguishing between genuine emergencies and situations where alternative financial means may be suitable prevents unnecessary borrowing and potential financial strain. For instance, a sudden medical emergency requiring immediate treatment or a critical car repair necessary for transportation to work qualifies as genuine emergencies that warrant urgent money loans. On the other hand, taking advantage of emergency funds to cover non-essential expenses including entertainment or luxury purchases may not justify the high costs associated with these loans. In such cases, seeking other solutions like budget adjustments or short-term savings may be more appropriate. Carefully evaluating different circumstances enables informed decisions and responsible utilisation of funds.

Choosing the Right Loan Type

Emergency loans may come in various forms and selecting the appropriate loan type can significantly impact your financial stability. Payday loans, though offering quick access to cash, typically come with high-interest rates and fees, potentially trapping borrowers in a cycle of debt if not repaid promptly. Conversely, personal loans provide more favourable terms and flexibility in repayment but may require a good credit score and longer processing times. For those with poor credit histories, bad credit loans in Singapore might seem like a viable option, nevertheless, they are accompanied by strict terms and high interest rates, which can exacerbate financial difficulties in the long run. Understanding the terms, interest rates and repayment conditions of each loan type is crucial in helping you align with your financial situation and goals.

Learn more: Exploring Loan Options with Moneyplus: Your Guide to Financial Flexibility

Managing Loan Terms Effectively

Negotiating interest rates, repayment periods and associated fees are all key strategies in managing loan terms effectively. This influences your overall cost of borrowing and ability to repay the loan comfortably. Start by researching and comparing loan offers from multiple money lenders in Singapore to identify the most competitive terms available. Highlighting your creditworthiness, income stability and willingness to repay can sometimes persuade lenders to provide more favourable conditions. Additionally, consider leveraging any existing relationships with financial institutions or explore options for secured loans for lower interest rates. Most importantly, ensure that you have meticulously reviewed and understood all terms and conditions before agreeing to any loans to avoid unexpected costs or penalties.

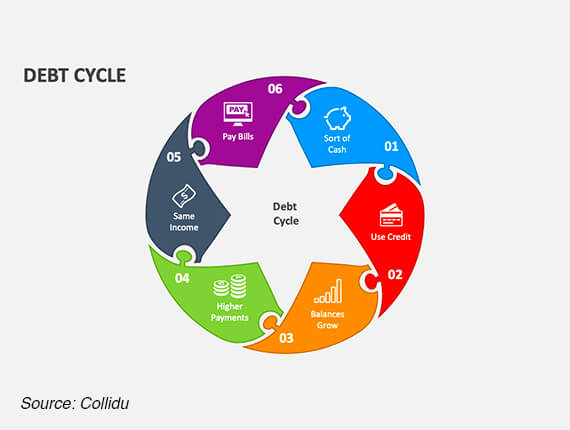

Avoiding Debt Traps

Source: Collidu

Focusing on immediate solutions is natural during emergencies, but considering the long-term repercussions is equally important. Falling into a debt trap can lead to a cycle of borrowing and repayment that becomes increasingly difficult to break, ultimately worsening your financial situation. High interest debts, damaging credit scores and experiencing ongoing financial stress are just some of the pitfalls. Fortunately, you can mitigate such risks in the following ways:

- Borrow only what you need and can realistically repay.

- Explore alternatives like budget adjustments, assistance from family or friends or tapping into savings accounts before resorting to emergency or fast cash loans.

- Create a repayment plan and budget for loan repayment to help you stay on track financially.

- Seek financial counselling or guidance from reputable sources for valuable insights and strategies to manage debt responsibly.

Taking proactive measures not only prevents debt but also allows you to navigate monetary emergencies more effectively and safeguard your long-term financial well-being.

While nobody wishes to endure financial strain, it’s an unfortunate reality that cannot always be avoided. However, by planning carefully and thinking strategically, you can overcome these challenges with composure, preserving financial freedom and flexibility!

Moneyplus Capital is a trusted and licensed money lender in Singapore. With a comprehensive range of loan services, we are here to deliver reliable financial support and ensure that your needs are met with care. Contact us today for more information.