As Licensed Money Lenders Singapore. We can consolidate your debt safely and affordably with licensed money lenders in Singapore. They offer customized plans to lower interest rates, simplify repayments, and regain control of your finances without the risk of unlicensed lenders.

Why Choose Licensed Money Lenders in Singapore

Managing multiple loans can be stressful, especially with high interest and scattered due dates.

Working with licensed money lenders Singapore lets you merge your debts into a single, manageable loan with clear terms and protected borrower rights.

At Moneyplus Capital, we make debt consolidation and personal loans simple, legal, and transparent under the guidelines of the Registry of Moneylenders (ROM).

What Are Licensed Money Lenders in Singapore?

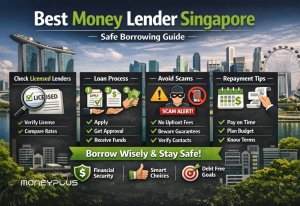

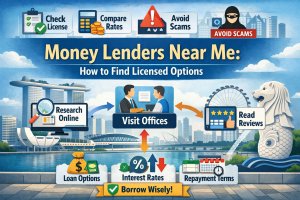

Licensed money lenders are companies approved by the Ministry of Law to offer regulated loan services to individuals and businesses.

Unlike unlicensed lenders (loansharks), they must follow strict interest rate limits and loan caps.

Borrowers are protected under Singapore law, ensuring fair treatment and transparent costs.

Why Consolidate Debt with Licensed Money Lenders Singapore

1. Lower Interest Rates and Single Repayment

Merging your loans can significantly reduce your interest burden.

See our Debt Consolidation Loan Page for details.

2. Simplified Monthly Payments

Handle only one repayment date instead of many. This makes cash flow management easier and reduces stress.

3. Improved Credit Standing

Paying off multiple high-interest loans improves your credit profile over time, a step toward financial stability.

4. Secure Legal Processes

Licensed money lenders are audited by the Ministry of Law. All loan agreements are documented and transparent.

5. Flexible Options for Bad Credit Borrowers

Even if you’ve faced rejections before, licensed money lenders in Singapore offer bad credit loan Singapore options to help you regain control.

Types of Loans Available from Licensed Money Lenders Singapore

Each loan type is tailored to specific needs, whether it’s clearing debts or handling unexpected expenses.

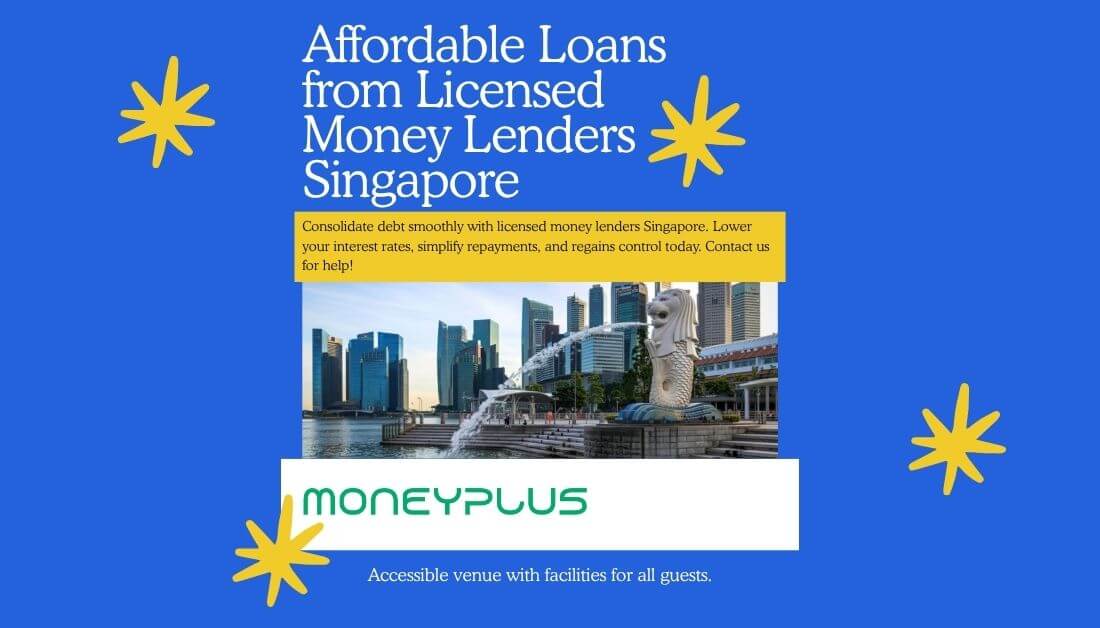

How to Apply for a Loan with Licensed Money Lenders Singapore

- Assess Your Finances: Determine how much you need and what you can repay.

- Apply Online: Submit your details through the Moneyplus Application Form.

- Get Verified and Approved: Verification takes less than an hour in most cases.

- Receive Funds Fast: Enjoy same-day cash disbursement for eligible borrowers.

Benefits of Choosing Moneyplus Capital

- Licensed and Transparent: Fully approved by the Ministry of Law.

- Fast Approval: Get your loan approved in hours, not days.

- Trusted Reputation: Ranked among the best money lenders in Singapore for 2025.

- Customer Focused: We provide personalized solutions for every borrower.

Frequently Asked Questions: Licensed Money Lenders Singapore

1. Is debt consolidation legal in Singapore?

Yes. When done through licensed money lenders, it’s regulated and safe under MinLaw’s guidelines.

2. Can I apply if I have a bad credit score?

Yes we offer bad credit loan Singapore solutions with affordable repayment plans.

3. How fast can I get approved?

Most borrowers get approval within 24 hours, especially for urgent cash loan requests.

4. Are there hidden fees?

No all charges are stated clearly in the loan agreement as required by the Registry of Moneylenders.

Responsible Borrowing Licensed Money Lenders Singapore

Borrow wisely, only take loans you can repay comfortably.

Verify every lender on the official ROM website to avoid illegal scams and protect your finances.

Conclusion

Choosing licensed money lenders in Singapore lets you manage your finances responsibly, safely, and legally.

Debt consolidation with Moneyplus Capital ensures you get affordable rates and trusted service from a reliable short-term loan provider in Singapore 2025.

Contact us today for more information.

Hours: 11:00 AM – 7:00 PM, Monday to Saturday. Closed on Sundays & Public Holidays.