Thinking of taking a loan in Singapore? Before you sign anything, it’s important to understand your loan agreement. The Best Moneylender in Singapore will always provide a clear and fair contract. This simple guide will help you know what to expect and how to borrow safely.

What Is a Loan Agreement?

A loan agreement is a legal contract between you and a licensed moneylender. It explains:

- How much you are borrowing

- The interest rate and fees

- When and how you will repay the loan

- What happens if you pay late

Licensed lenders follow strict rules set by the Ministry of Law to protect borrowers. Always ensure your lender is listed in the MinLaw Registry.

Why Is the Loan Agreement Important?

Your loan agreement protects you. It ensures you know:

- The total cost of your loan

- Your rights as a borrower

- The terms and conditions you are agreeing to

At Moneyplus, we make sure you understand every part of your agreement before you sign.

Key Parts of a Loan Agreement

1. Loan Amount

How much you are borrowing from the lender.

2. Interest Rate

How much extra you will pay on top of the loan amount. Licensed lenders follow legal limits.

3. Repayment Schedule

When your payments are due and how often you must pay.

4. Fees and Charges

Any extra costs, like admin fees or late payment fees.

5. Rights and Responsibilities

What you and the lender are expected to do under the agreement.

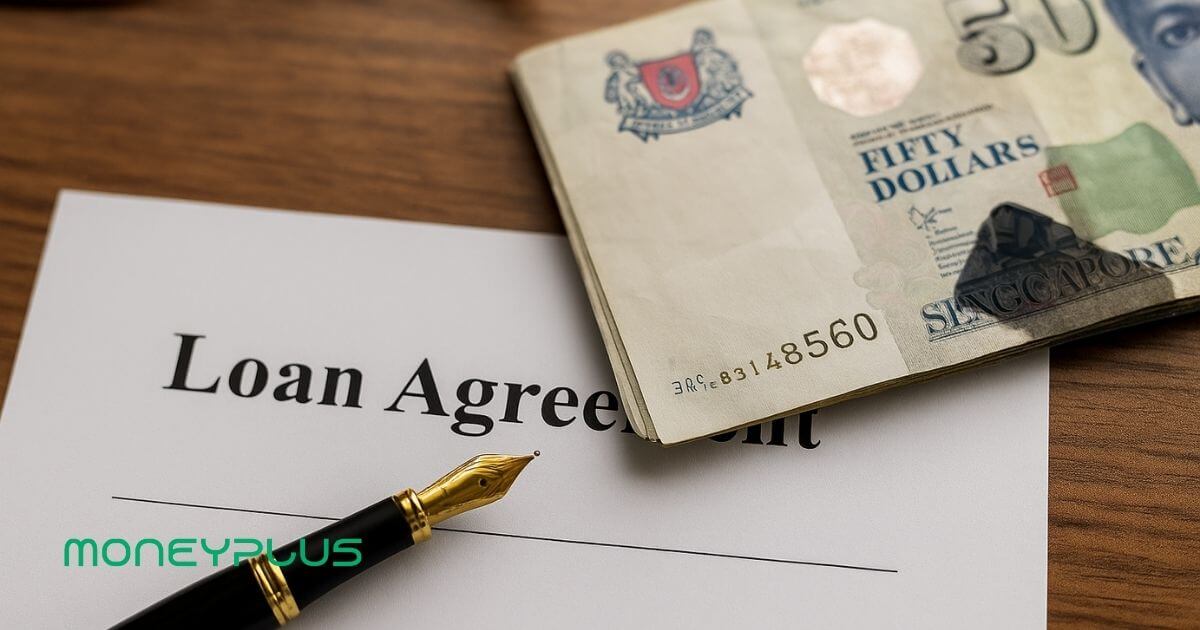

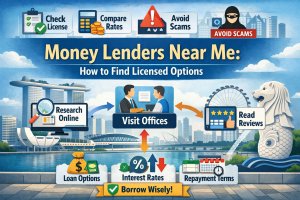

How to Borrow Safely in Singapore

1. Check the Lender’s License

Make sure the lender is listed in the MinLaw Registry.

2. Read Before You Sign

Ask questions if you are unsure about anything in the agreement. A trusted lender will explain it clearly.

3. Don’t Pay Upfront Fees

Licensed lenders will not ask for payment before giving you the loan.

4. Borrow What You Can Repay

Only take a loan amount that you are confident you can repay on time.

Common Types of Licensed Loans

Fast Urgent Cash Loan

For quick cash during emergencies. Learn more on our Fast Urgent Cash Loan page.

Personal Loan

For everyday needs like home improvements, education, or family expenses. More details are available on our Personal Loan page.

Debt Consolidation Loan

To combine several debts into one easy payment. Discover the benefits on our Debt Consolidation Loan guide.

Wedding Loan

To fund your big day without financial stress.

Travel Loan

To plan and enjoy your holiday.

Medical Loan

To pay for unexpected healthcare costs.

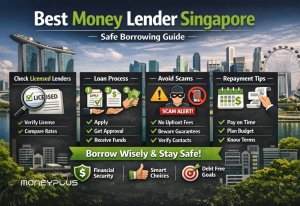

Other Trusted Licensed Moneylenders in Singapore

Besides Moneyplus, other well-known licensed moneylenders include:

- Lending Bee

- Lendela

- Lendingpot

- Roshi

Each offers different loan types, but Moneyplus stands out for personal service and fast support near Bugis Junction.

How Moneyplus Supports You

As one of the Best Moneylenders in Singapore, Moneyplus provides clear guidance and support. You can start with an online application or visit us in person at 371 Beach Road.

Conclusion: Borrow Smart With the Best Moneylender in Singapore

Loan agreements are there to protect you. When you understand them, you can borrow with confidence.

Ready to explore your options? Start with the Moneyplus and check our MinLaw listing to confirm our credentials. Contact us for more information.

Borrow safe, borrow smart with the Best Moneylender in Singapore.