Though Singapore boasts a rich and flourishing economy, personal unforeseen circumstances may render certain people to be categorised under a low-income bracket. This group may struggle with financial responsibilities and obligations, especially in light of the nation’s recent rising costs of living. Fortunately, there are various solutions available for aid including monetary loans. However, requesting a loan involves several factors to consider, such as eligibility criteria and processes, especially in our rigorously regulated state. In this article, we explore everything you need to know about personal loans for low-income individuals in Singapore to empower greater financial inclusion.

Understanding the Need for a Personal Loan

Taking the time to evaluate the need for a personal loan ensures that individuals are borrowing responsibly and taking on debt only when it is absolutely necessary and beneficial to the situation. Unexpected medical expenses, urgent home repairs or sudden job losses are circumstances that can disrupt financial stability. In such cases, urgent money loans can serve as a vital solution to address immediate financial needs, providing quick access to funds without collateral. Furthermore, personal loans in Singapore often offer flexible repayment terms, allowing borrowers to handle repayments according to their financial capabilities. Nonetheless, always remember that having a financial management plan is still critical to avoid falling into a cycle of debt.

Eligibility Criteria and Application Process

The personal loan eligibility criteria may vary on a case-by-case basis depending on the lender. For low-income individuals, the income requirement may be easier to meet than those with higher incomes. As a general guide, licensed moneylenders in Singapore require applicants to be Singapore citizens or permanent residents, aged between 21 and 65 years old, with a stable source of income. Credit history, employment stability and debt-to-income ratio are also important factors when assessing eligibility. Some lenders may offer specialised loan products tailored to the low-income group, providing more versatile eligibility criteria and repayment terms. Researching different lenders and loan options is key to finding one that best suits specific financial circumstances. Beyond eligibility criteria, the subsequent step involves navigating through the application process.

Learn more: Maximising Your Personal Loan Eligibility: Unveiling the Loan Amount You Can Secure Based on Your Salary

As a start, prepare the documentation needed. At MoneyPlus Capital, all we require is the borrower’s National Registration Identity Card Number (NRIC), latest 3 months pay documentation and Singpass. Applicants will then have to fill out an application form, listing accurate, personal information such as employment status, income and financial obligations. Before submitting the form and necessary documents, applicants need to ensure that the paperwork is legible and properly filled out to avoid delays in processing. The processing time may differ based on the lender, complexity and nature of the application (fast loan or personal loan). Once successful, it is advisable to review the terms and conditions and pay close attention to interest rates, repayment schedules, fees, and any other terms specific to the approved loan. Our team will be happy to guide each applicant through this step.

Financial Literacy and Responsible Borrowing

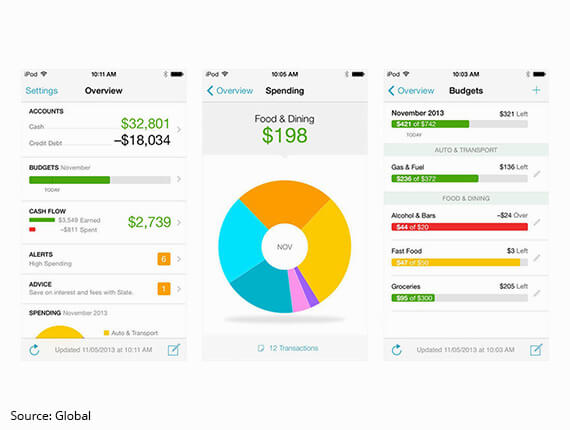

After attaining their loan, borrowers might tend to neglect the significance of a repayment strategy. Yet this is crucial to staying out of debt. Here, financial literacy comes into play, facilitating informed financial decision-making and the navigation of limited resources effectively. By familiarising with concepts like budgeting, saving, borrowing and credit management, low-income individuals can stretch their income further, prioritise essential expenses and identify opportunities for financial growth.

For instance, creating and sticking to a realistic budget through monetary tools that account for all income and spending is a great way of managing finances. Practising good habits including saving up regularly, avoiding unnecessary spending and building an emergency fund to cushion against unexpected expenses also empowers more efficient financial handling. With financial literacy and responsible borrowing, taking control of finances and working towards financial goals becomes much easier.

In times of crises, personal loans or fast cash loans can make all the difference in keeping one afloat to tide through difficult situations. Even so, it is important to weigh the options and conduct thorough research before committing.

Key Considerations for Low-Income Individuals Seeking Loans

Interest Rates

Keep in mind that the advertised interest rate (AIR) and effective interest rate (EIR) differ. While the AIR only covers the basic interest charged, the EIR includes additional costs such as administrative fees and adjusts for the decreasing principal balance throughout the loan term.

Additional Charges

In addition to the interest rate, there are other fees to consider, such as application fees, processing fees, early repayment fees, and late payment charges, all of which can significantly affect the total cost of the loan.

Repayment Terms

Carefully review the repayment terms to ensure you have the means to make timely monthly payments throughout the loan tenure.

Loan Amount

Banks consider various factors when determining the borrowing amount, such as your credit score, monthly income, and banking relationship. Typically, individuals with annual incomes ranging from S$30,000 to S$120,000 can borrow up to 4 times their monthly salary.

Moneyplus Capital is your trusted partner and we understand the need for reliable financial support during life’s twists and turns. As a licensed and regulated moneylender in Singapore, we prioritise professionalism, transparency and flexibility, guaranteeing that your unique financial needs are met with care. Contact us today for more information.

FAQs about Personal Loans for Low Income Individuals

What happens if you miss a loan repayment?

Failure to make payments on time incurs additional interest charges, late fees, and penalties, and can negatively affect your credit score.

What constitutes a low income threshold in Singapore?

An annual income of S$30,000 and below. However, there are options for individuals with lower incomes.

Do low-income borrowers face higher interest rates on personal loans?

Yes. Lower-income borrowers may be perceived as higher risk by lenders, leading to higher interest rates to offset the perceived risk of default. It is advisable to compare loan offers from different lenders for the most favourable terms.