Introduction Licensed Money Lender Singapore for Low-Income Borrowers

Though Singapore boasts a strong economy, rising costs of living leave some individuals struggling to manage financial obligations. For low-income borrowers, a licensed money lender singapore can provide safe and regulated loan options. From urgent medical bills to sudden home repairs, loans help bridge financial gaps when handled responsibly.

Why Personal Loans Are Needed for Low-Income Groups

Personal loans ensure financial inclusion by offering relief during emergencies. A bad credit loan singapore or urgent cash loan today can cover expenses like:

- Unexpected healthcare costs

- Sudden job loss

- Emergency home repairs

Flexible repayment plans allow borrowers to meet obligations without spiraling into debt. Responsible borrowing, however, requires planning and a clear repayment strategy.

Eligibility Criteria with a Licensed Money Lender Singapore

Borrowing from a licensed money lender singapore comes with clear eligibility guidelines under the Ministry of Law:

- Must be a Singapore Citizen or Permanent Resident

- Age between 21 and 65

- Stable source of income

- Review of debt-to-income ratio

Some lenders also provide options tailored to low-income groups, making repayment terms more manageable.

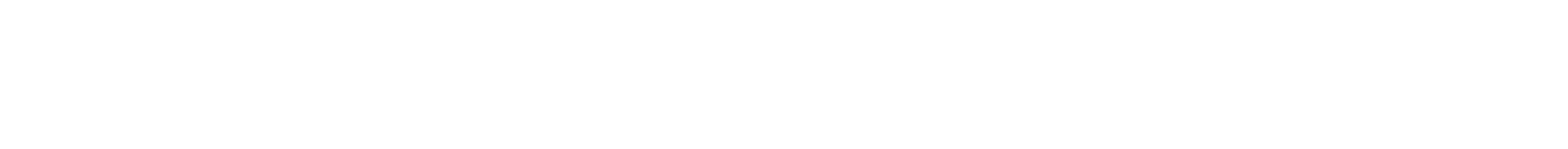

How to Apply – Step-by-Step Guide

Applying with a best licensed money lender singapore involves straightforward steps:

- Prepare your NRIC, latest 3 months’ payslips, and Singpass details

- Complete the loan application with accurate personal and financial data

- Submit documents clearly to avoid delays

- Review loan terms carefully, including repayment schedules and fees

Fast approvals make this process easier, especially when working with a best moneylender in singapore that values transparency.

FAQ – Licensed Money Lender Singapore

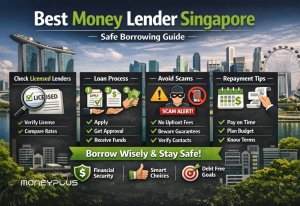

Q1: How do I know if a money lender is licensed?

A1: Always check the official ROM licensed moneylenders list.

Q2: Can low-income borrowers get approval?

A2: Yes. Licensed lenders assess repayment ability, not just income level.

Q3: What loan types are available?

A3: Personal loans, payday loan singapore, debt consolidation, and fast cash loan singapore options are available.

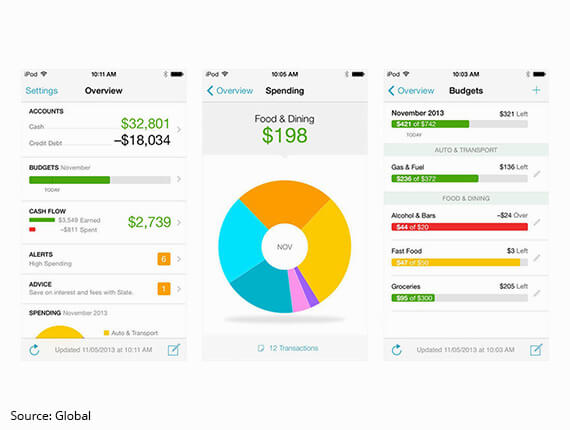

Financial Literacy & Responsible Borrowing

After securing a loan, financial literacy ensures long-term stability. Borrowers should:

- Create a realistic budget

- Save regularly

- Avoid unnecessary spending

- Build an emergency fund

This approach helps borrowers avoid over-reliance on credit and positions Moneyplus as a reliable money lenders in Singapore 2025.

Key Considerations When Borrowing

Interest Rates

Understand the difference between AIR (advertised interest rate) and EIR (effective interest rate).

Additional Charges

Look out for processing fees, early repayment fees, and late penalties.

Repayment Terms

Ensure monthly repayments are sustainable throughout the loan tenure.

Loan Amount

Lenders usually calculate borrowing limits based on monthly income and repayment capacity.

Debt Consolidation with a Licensed Money Lender Singapore

Managing multiple loans can be stressful. A debt consolidation loan combines repayments into one structured plan. This approach reduces interest, simplifies payments, and makes budgeting easier. It’s a service offered by the best money lenders singapore to support long-term financial stability.

Conclusion – Borrow Safely with a Licensed Money Lender Singapore

Working with a licensed money lender singapore ensures transparent terms, regulated practices, and responsible lending. For low-income individuals, this creates opportunities to meet urgent needs while staying financially secure.

Contact us today for more information.

Hours: 11:00AM – 7:00PM Monday to Saturday. Closed on Sundays & Public Holidays.

Moneyplus Capital

371 Beach Road, #02-25 City Gate, Singapore 199597

Tel: +65 6904 7073