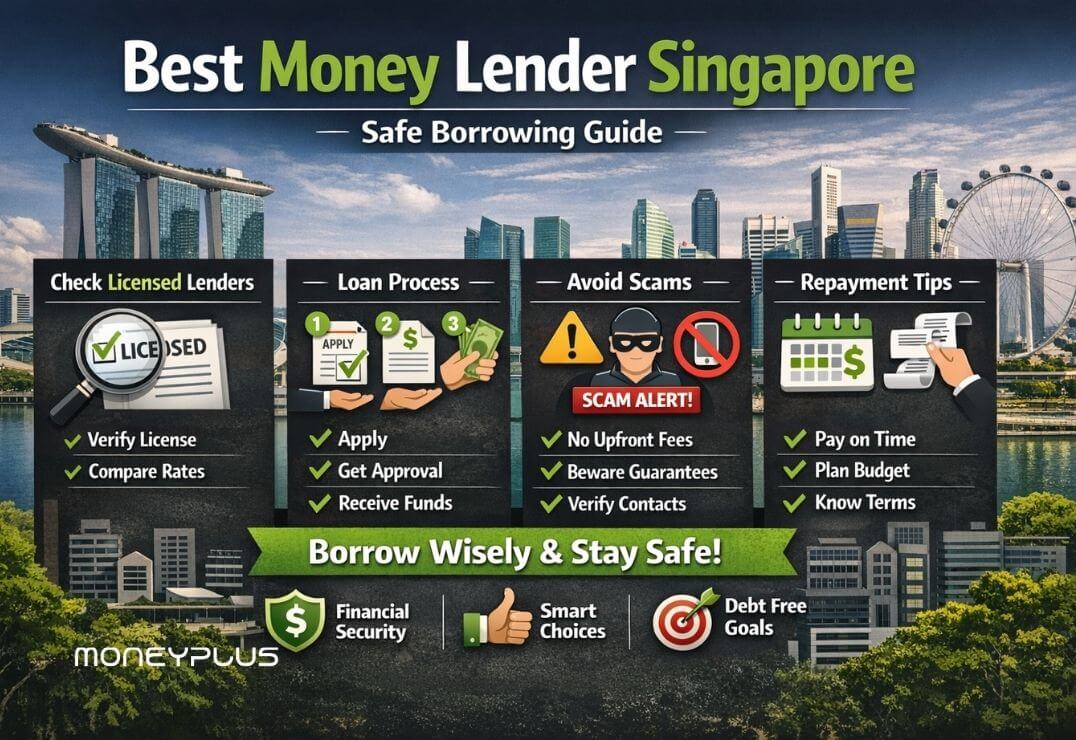

Finding a reliable Best Money Lender Singapore loan provider in Singapore requires careful research, especially when financial needs arise unexpectedly. Whether you are searching for money lenders near me or comparing options online, understanding how licensed lenders operate helps you borrow responsibly and confidently within Singapore’s regulations.

In this guide, we explain how to identify trustworthy loan services, explore common loan types available locally, and avoid common risks. This information is especially useful for borrowers looking for regulated solutions offered by licensed lenders such as Moneyplus Capital Pte Ltd.

Understanding Licensed Moneylenders in Singapore

A best licensed moneylender in Singapore must be approved by the Ministry of Law and follow strict regulations. These rules are designed to protect borrowers, ensure transparent terms, and prevent unfair lending practices. Choosing a trusted money lender Singapore residents rely on starts with verifying licensing details and business legitimacy.

Licensed lenders clearly disclose interest rates, repayment schedules, and fees. This transparency helps borrowers make informed decisions, particularly when comparing a best licensed money lender in Singapore against unverified alternatives.

Common Loan Types Available Locally

Many borrowers seek a Personal Loan Singapore residents can use for everyday expenses such as bills or home needs. These loans typically come with structured repayment plans and clearly stated terms.

Short-term needs may require a Payday Loan Singapore, while individuals facing credit challenges may explore options tailored for Bad Credit Singapore borrowers. Licensed lenders assess affordability rather than making unrealistic promises.

Loans for Urgent and Emergency Needs

Unexpected expenses often lead people to search for an urgent loan today or an emergency loan Singapore solution. Licensed lenders offer structured products designed to address urgent financial gaps without encouraging reckless borrowing.

A Fast Urgent Cash Loan Singapore option may be suitable for short-term needs, provided the borrower understands repayment obligations fully before proceeding.

Loan Options for Life Events and Planning

Some loans are designed for specific life milestones. For example, a Wedding Loan Singapore can help manage ceremony-related costs, while a Medical Loan Singapore may assist with healthcare expenses not fully covered by insurance.

Borrowers planning holidays may explore a Travel Loan Singapore, whereas temporary financing needs between major transactions may require a Bridging Loan Singapore under regulated terms.

Managing Debt More Effectively

When multiple repayments become difficult to manage, a Debt Consolidation Loan Singapore can simplify finances by combining outstanding balances into one structured repayment.

Borrowers may also encounter options described as a debt-consolidation loan or money-lender solution. These services aim to improve repayment clarity, especially when offered by a debt consolidation loan moneylender Singapore residents trust.

How to Compare Lenders Near You

Searching for a loan near me or evaluating money lenders online requires careful comparison. Look for clear office locations, published license numbers, and accessible customer support.

Some borrowers prefer visiting a money lender Bugis location for face-to-face discussions, while others may opt for a licensed online money lender Singapore residents can access digitally.

Identifying the Right Lender for Your Needs

The term best moneylender should not be based on marketing claims alone. Instead, borrowers should evaluate service transparency, customer support quality, and compliance history.

A best money lender Singapore option is one that prioritises responsible borrowing and long-term affordability. Similarly, the best money lender in Singapore should provide realistic loan structures rather than aggressive approvals.

Trust and Reputation Matter; Best Money Lender Singapore

The best licensed money lender Singapore residents rely on will always operate within legal boundaries and communicate clearly. Many borrowers consider reviews, office accessibility, and regulatory compliance when choosing the best loan Singapore option.

Ultimately, working with the best licensed money lender Singapore borrowers trust reduces risk and improves financial outcomes.

Best Money Lender Singapore; Trust and Reputation Matter

The best licensed money lender Singapore residents rely on will always operate within legal boundaries and communicate clearly. Many borrowers consider reviews, office accessibility, and regulatory compliance when choosing the best loan Singapore option.

Ultimately, working with the best licensed money lender Singapore borrowers trust reduces risk and improves financial outcomes.

About Best Money Lender Singapore

Moneyplus Capital is a licensed moneylender operating in Singapore, offering regulated loan services that follow Ministry of Law guidelines. As Moneyplus Capital Pte Ltd, the company focuses on transparent processes, clear communication, and responsible lending practices tailored to local needs.

Frequently Asked Questions (FAQ)

How do licensed loan services work in Singapore?

Licensed loan services follow strict rules on interest rates, fees, and borrower protection set by Singapore authorities.

Can I visit a Best Money Lender Singapore before taking a loan?

Yes. Visiting a licensed lender’s office allows you to review loan terms and understand repayment obligations clearly.

Are loan services available for urgent needs?

Yes, but borrowers should always review contracts carefully even when funds are needed urgently.

How do I confirm a Best Money Lender Singapore is licensed?

You can verify licensing through the official Ministry of Law Registry before engaging any loan service.

Conclusion

Choosing the right loan provider in Singapore is about safety, clarity, and responsibility. By understanding licensed lending practices, loan types, and regulatory protections, borrowers can make informed financial decisions without unnecessary risk. If you would like to learn more about licensed loan options available locally, Contact us today for more information. Or Apply now!

Hours: 11:00AM – 7:00PM Monday to Saturday. Closed on Sundays & Public Holidays.